Swiss-Japanese Relations

History

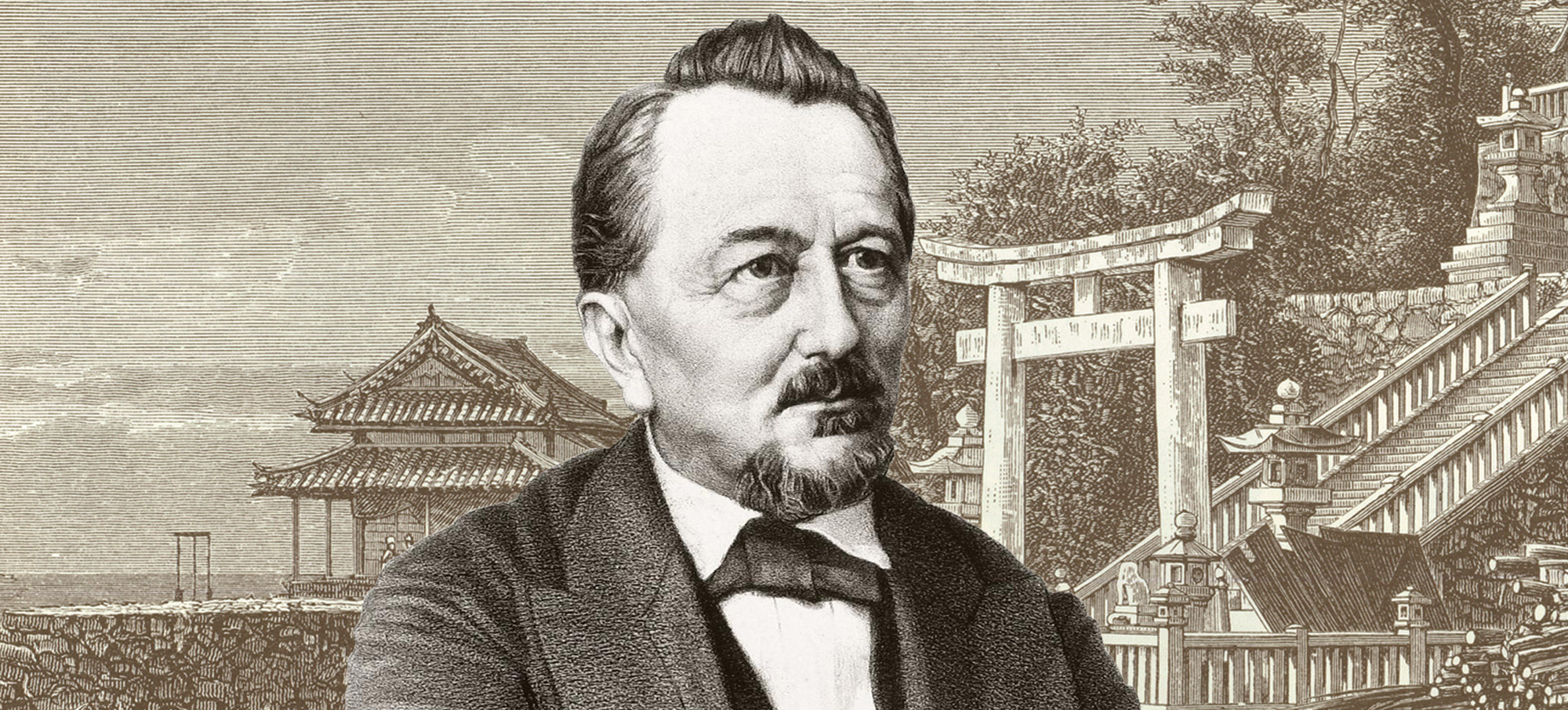

Switzerland sent its first official trade delegation to Japan in 1863. It was headed by Aimé Humbert, a representative of Union Horlogère (Swiss watch industry). This visit eventually led to the conclusion of a trade and friendship treaty between the Swiss Federal Government and the Japanese Shogun in 1864. For more detailed information, please refer to the page below:

Grand Tour of Switzerland in Japan – Aimé Humbert-Droz (1819-1900)

©FDFA

Agreement on Free Trade and Economic Partnership between Switzerland and Japan (FTEPA)

Full FTEPA legal frameworkThe FTEPA, which came into force on September 1, 2009, establishes a comprehensive economic partnership between Japan and Switzerland (as well as Liechtenstein). It contains substantive provisions on trade in goods referring to the liberalization of trade in industrial products as well as selected processed and basic agricultural products, rules of origin, custom procedures, trade facilitations and provisions relating to non-tariff barriers. Other provisions relate to the trade in services, the movement of natural persons for business purposes, the establishment and protection of investments, the protection of intellectual property, the promotion and facilitation of electronic commerce, provisions in the field of competition and the promotion of a closer economic relationship.

Japan-Switzerland FTEPA signing ceremony between Vice President Ms. Doris Leuthard and Minister for Foreign Affairs Mr. Hirofumi Nakasone (©MOFA)

Bilateral Japan-Switzerland trade

Embassy of Switzerland - Economic Report Japan 2023

For Switzerland, Japan is the third most important trading partner in Asia (2% of total trade in 2022), a major investment location (rank 4 among foreign investors) and a weighty “like-minded” ally.

In 2022, Swiss merchandise exports to Japan accounted for CHF 9.3 bn (+21.5%), while imports totaled to CHF 5.7 bn (+16.9%). In all, this represents a trade volume of CHF 15 bn (highest ever recorded), with a surplus of CHF 3.6 bon for Switzerland.

In terms of foreign direct investments (FDI), Swiss companies were responsible for USD 16.5 bn of outbound FDI in Japan, making Switzerland the fourth largest European investor and eighth largest overall. In return, Japanese firms invested USD 42.3 bn in Switzerland (-8.0%). In Europe, Japanese FDI are only higher in the UK, the Netherlands, and Germany.

In 2023, while the adjustment of the bilateral free trade agreement is in the forefront, an agenda is yet to be fixed. In the area of science, technology and innovation, the opening of the Swissnex office in Osaka in September 2023 ahead of the 2025 World Exposition symbolizes the dynamization of the two countries’ relationships.

Additional information about Switzerland & Japan

CUSTOMS & CULTURE

• Japan: The Government of Japan – About Japan

• Switzerland: Presence Switzerland (PRS) – Discover Switzerland

BUSINESS ETIQUETTE

• Japan: JETRO – Communicating with Japanese in Business

• Switzerland: Swissinfo.ch – How to fit in at a Swiss workplace

DOMESTIC MARKET TRENDS

• Japan: JETRO – Reports and Statistics

• Switzerland: State Secretariat for Economic Affairs (SECO) – Economic forecasts