Tokyo (SCCIJ) – The judicial quarrel between the Swiss pharmaceutical giant Roche and the U.S.-Irish rare disease specialist Shire about an alleged patent infringement has been buoyed by a ruling in Japan. A Tokyo court decided in favor of the Swiss group and its majority-owned Japanese subsidiary Chugai and recommended the dismissal of Shire’s challenge with regard to the haemophilia drug Hemlibra. Their fight in court is becoming even more interesting due to the announced negotiations of Japan’s largest pharmaceutical company, Takeda, to take over Shire.

“Patent not infringed”

The Japanese ruling may not have a direct influence on other judicial challenges outside Japan but it is still considered an important decision. In a statement, the company said the court ruled that Hemlibra (emicizumab) “does not infringe patent 4313531, held by Shire’s wholly-owned subsidiaries Baxalta Inc and Baxalta GmbH”.

Hemlibra is the first new medicine in over 20 years to treat people with haemophilia A with inhibitors to factor VIII. This is an inherited, serious disorder in which a person’s blood does not clot properly, leading to uncontrolled and often spontaneous bleeding. Haemophilia A affects around 320,000 people worldwide, approximately 50 to 60 percent of whom have a severe form of the disorder.

Production at Roche

Prophylactic treatment per injection

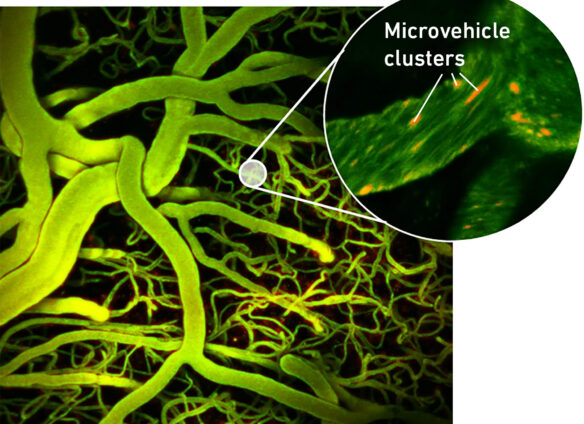

Hemlibra is an antibody that brings together proteins required to activate the natural coagulation cascade and restore the blood clotting process for people with haemophilia A. Hemlibra is a prophylactic treatment that can be administered by an injection of a ready-to-use solution under the skin (subcutaneously) once-weekly.

The drug was created by Chugai Pharmaceutical Co., Ltd. and is being co-developed by Chugai, Roche and Genentech. It is marketed in the United States as Hemlibra (emicizumab-kxwh) for people with haemophilia A with factor VIII inhibitors. In February, the European Commission approved Roche’s Hemlibra for people with haemophilia A with inhibitors.

Big market for haemophilia drugs

According to the specialist website PMLive, with Hemlibra, Roche is trying to break into a market for haemophilia drugs worth around 7 billion dollars in the world’s top seven markets (US, France, Germany, Italy, Spain, the UK and Japan) last year. The haemophilia A with inhibitors category is currently dominated by Shire and Novo Nordisk with its Feiba and NovoSeven bypassing agents (PBAs).

In the meantime, the Japanese pharma market leader Takeda confirmed that it is considering making an offer for Shire, the U.S. company suing Roche for patent infringement. Takeda’s consideration of such an offer is at a preliminary and exploratory stage and no approach has been made to the Board of Shire. There can be no certainty that an approach, if made, will lead to any transaction, Takeda said.

The company continuously considers various options aiming to accelerate its growth, focusing on prioritized therapeutic areas of gastroenterology, oncology and neuroscience plus vaccines, Takeda said in a reaction to media reports about its intention to buy Shire.

Takeda has made a number of large acquisitions during the last couple of years. In 2011, it bought the Swiss pharma company Nycomed.

Creating a biopharmaceutical leader

Takeda believes that a potential transaction with Shire presents an opportunity to advance Takeda’s stated Vision 2025, build on its current strong momentum, and create a truly global, value-based Japanese biopharmaceutical leader. In particular, a transaction with Shire would:

- strengthen Takeda’s core therapeutic areas of oncology, gastrointestinal and neuroscience;

- accelerate Takeda’s vision to be a leader in specialized medicines that are transformative to patients through the addition of Shire’s leading global rare disease franchise;

- reinforce a strong and large-molecule focused late-stage pipeline within Takeda’s core therapeutic areas to complement Takeda’s own pipeline and discovery capabilities;

- balance Takeda’s geographic focus to align with the market opportunity in the U.S.

Any potential bid for Shire, if made, would have to align with this strict investment criteria, Takeda said. The financial market already lowered its thumb on this news. The shares of Takeda fell sharply because the bid could have a value of up to 50 billion dollars.

Text: SCCIJ with material of Roche and Takeda, Photo: Roche