Tokyo (SCCIJ) – Sandoz, a Novartis Group company, will buy the Japanese business of Aspen Global Incorporated (AGI), for up to EUR 400 million. With the acquisition, Sandoz can expand its presence in the world’s third-largest marketplace for generics. We are reinforcing our strategic focus on Japan, the company said in a statement.

Novartis Headquarters in Basel, Switzerland

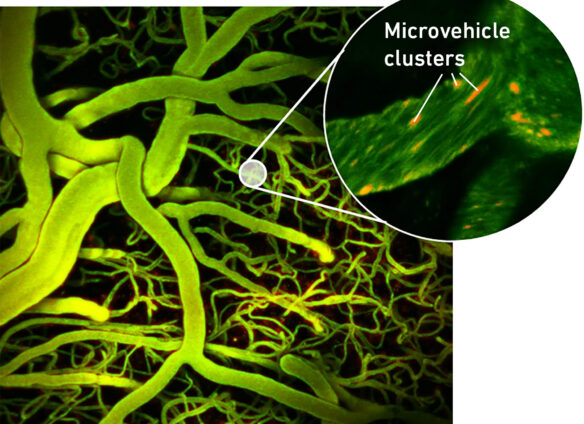

Off-patent pharmaceutics

Sandoz is the generics subsidiary of the pharmaceutical giant Novartis from Basel, Switzerland. The Japanese government is pushing for the use of more generics to lower the expenses of its public health insurance. Generics are cheaper because, after the expiration of the original license, every maker can produce such medicine.

The acquisition consists of shares in Aspen Japan K.K. and related assets. Sandoz will make an initial cash settlement of Euro 300 million upon completion of the transaction. Also, the company has agreed to make deferred payments of up to Euro 100 million under certain conditions. The deal is expected to close in the first half of 2020.

Aspen’s portfolio in Japan comprises approximately 20 products, now off-patent branded medicines with a focus on anesthetics (including Xylocaine), specialty brands (including Imuran), and local brands. Full-year sales for the fiscal year ending in 2019 were EUR 130 million. Aspen Japan is a wholly-owned subsidiary of AGI and forms part of the Aspen Group headquartered in Durban, South Africa.

Manufacturing and supplies included

The acquisition would complement the Sandoz broad portfolio and pipeline of hospital generic and biosimilar products with a dedicated sales, marketing, and medical organization, thereby enhancing its ability to serve patients and customers in the hospital channel.

Additionally, AGI has entered into a five-year manufacturing and supply agreement (with an additional two-year extension option) with Sandoz. It will take effect from completion of the transaction and cover the supply of active pharmaceutical ingredients, semi-finished, and finished goods related to the portfolio of divested brands.

“Excellent opportunity”

“The acquisition of Aspen’s Japanese operations would significantly strengthen our position in this country, a stable but growing generics market. We are committed to helping address patient, and customer needs in the market as we aspire to become the world’s leading and most valued generics company,” said Sandoz CEO Richard Saynor.

Stephen Saad, Aspen Group Chief Executive, explained the sale of its Japanese generics subsidiary with a focus on its core pharmaceutical business. But the strong management team, dedicated staff, specialty portfolio, and the commercial platform would represent an excellent opportunity for Sandoz when combined with their Japanese portfolio and product pipeline, Saad said.

Text: SCCIJ with material of Sandoz and Aspen Group; Photo: © Novartis